Understanding vulnerability

Most people will face vulnerability at some point in their lives, and without the appropriate level of care, some could be at risk of harm. You may already work with vulnerable clients who may benefit from additional care and support because of their circumstances. We’re committed to providing you with the resources to help you support their needs, and minimise any risks.

The FCA defines vulnerable customers as ‘someone who, due to their personal circumstances, are especially susceptible to harm - particularly when a firm is not acting with appropriate levels of care.’

We have partnered with AKG on their latest industry research paper which explores key issues relating to vulnerable customers and financial wellbeing. If you'd like to read a copy of the report, you can request a copy.

-

Resources for advisers

Request the AKG report Consumer Duty Health and wellbeing online guideQuick links

id

Drivers of vulnerability

-

Health conditions

Conditions or illnesses that affect the ability to carry out tasks

-

Life events

Major, unexpected and disruptive life events e.g., divorce or bereavement

-

Resilience

Low ability to withstand financial and/or emotional shocks

-

Capabilities

Low knowledge, confidence, or inexperience in financial and other matters

Support for advisers

Identify vulnerability

Your clients may not recognise themselves as being vulnerable or be willing to share personal information, so it’s often difficult to recognise if a client needs extra support. You’ll be in a unique position to identify these and will pick up on things like:

- making statements such as: my circumstances have changed/my partner used to deal with this/I can’t make a decision/I’ve lost my job/ there’s no other options I can see

- appearing nervous, distressed or anxious/becoming flustered or emotional

- changing the subject or repeatedly asking the same questions/asking for information to be repeated

You might also pick up key indicators through other data sources.

- a change in their financial/accounts history

- the frequency or method of communication has changed – i.e., always telephoned and they’re now emailing?

- any unusual activity on their account, such as unexpected increased withdrawals

Recording vulnerability

Having identified a vulnerability, recording and sharing information with the provider, with your client’s agreement, can also help to safeguard their needs.

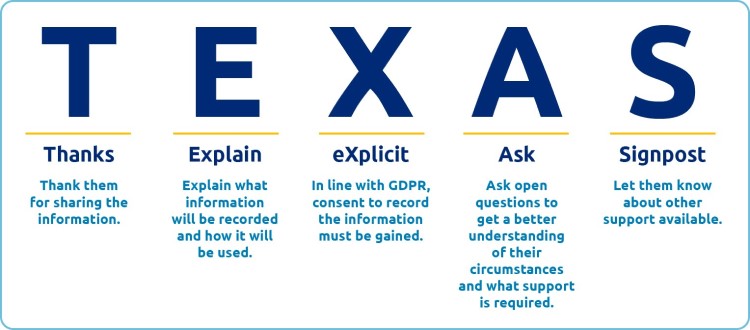

When we identify a vulnerable customer our people use ‘TEXAS’ which is a recognised tool that can be used to record information respectfully and compliantly – which we’ve shown below should this be helpful for your own purposes.

id

-

47% of UK adults showed one or more characteristics of vulnerability

-

One in four UK adults have low financial resilience

-

Advisers underestimate the number of their vulnerable customers by 12%

How Standard Life can help you and your clients

Our support options are split into different categories:

- We have solutions in place for a wide range of vulnerabilities, e.g., providing documents in large print for those with a sight impairment, a translator for those whose first language is not English or faster payments for those in financial hardship.

- We signpost external services available to your clients to help them access further, specialist support. These include National Debtline and Samaritans – you can find more details of support services.

-

Consumer Duty

Need help getting ready for the new Consumer Duty? You can find out everything you need to know on our Consumer Duty web hub.

-

Helpful documents

Download and share with your clients who may need additional support when making decisions.

-

Request a call back

Arrange a call back from our distribution team by clicking the box below.