Pensions

How much attention should I give to my pension plan when I’m 30 or under?

Discover how much attention you should give to your pension plan when you’re aged 30 or under, and learn how focusing on your plan early could benefit you in the future.

id

<p class="subtitle">If you’re 30 or under, retirement probably feels like a long way off – so your pension plan may not be at the forefront of your mind. But here’s the thing about pension plans: the more attention you give them when you’re young, the more you could potentially benefit in future. We explore how much you should focus on your own plan now – and why you just might thank yourself for it later.

Keep an eye on your pension pot’s value and check where you’re invested

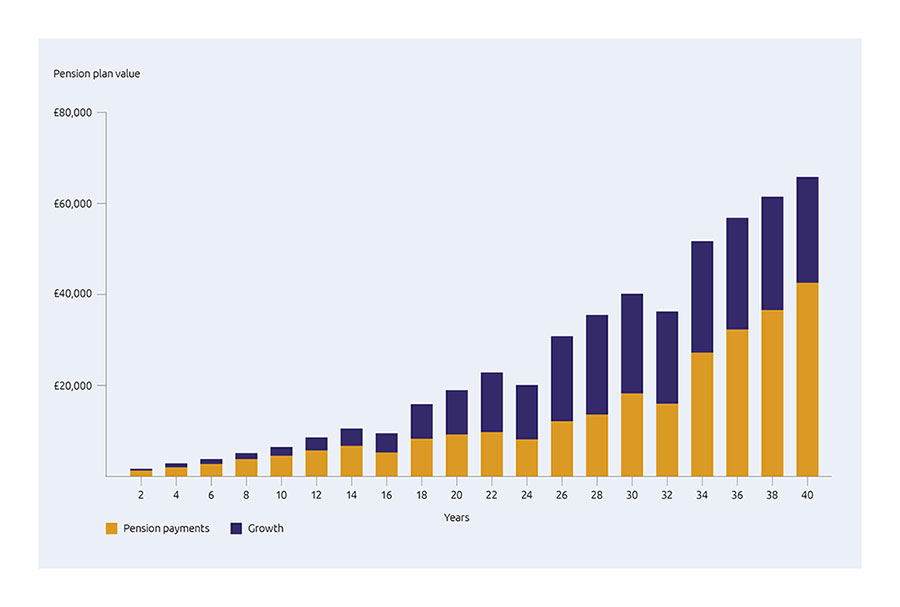

Money paid into your pension plan is invested, which can give your pension pot a chance to grow. Thanks to a process called compounding, you could even achieve growth on top of growth each year.

Generally, the longer your money’s invested, the more opportunity there is for your pot’s size to increase. So it makes sense to start saving into a plan as early as possible. Remember, the value of your investments can go down as well as up and may be worth less than was paid in.

id

This graph is for illustrative purposes only and isn’t based on real figures.

id

It’s worth checking on your pot’s value to see how your money’s doing. It could also be worth looking at where you’re invested and asking yourself whether your investment choices match up with your savings goals. Some people feel confident taking a little more risk with their investment choices when they’re younger, as there’s more time for their pension pot to recover from potential losses.

You can normally decide to change where you’re invested if you want to. Think carefully before doing this, as it’s important that you’re comfortable with where your money is invested.

Review how much is going into your workplace pension plan

When you start working, your employer will normally automatically enrol you into a workplace pension plan. It could be helpful to review how much is being paid into this each month.

When you have a workplace pension plan, not only do you pay into this – your employer usually does, too. Normally, their minimum payment is 3% of your ‘qualifying earnings’, while your minimum is typically 5%.

You’ll normally start paying into your workplace pension plan automatically. But you may want to check how much you’re putting in and adjust this depending on what’s right for your circumstances. For example, you might decide to pay in a little more each month.

You could also check how much your employer’s putting into your plan. They may be willing to pay in more than their minimum, so it could be worth asking them to see if that’s possible.

Some employers will even match your own payments up to a certain amount – meaning if you pay in more, they might too.

Make sure you know where your plans are

Due to auto-enrolment, you could find yourself with a new pension plan each time you change jobs.

Let’s look at an example: Anna leaves university at age 22 and goes into her first full-time job. She leaves to work at another company two years later. This means she’s got two pension plans before she’s even turned 25.

It’s important to make sure you know which providers you have pension plans with. And remember to keep your personal details up to date across all your plans. If you move house, for example, let your current and past providers know your new address.

It could be helpful to give your providers your personal email address (rather than your work one) to use as your primary email address. This is so your providers can still contact you when you leave your job. If you do use your work email address, make sure you update your providers with a different email address before leaving your job.

Some people lose track of their pension plans. But it could be much easier to keep tabs on your own ones if you have a record of your providers and update your details. This could save you a lot of time and admin in the future.

Get to know the tax benefits of your pension plan

A pension plan is a tax-efficient way to save for the future you want. So it’s worth getting familiar with the benefits of your own plan early on.

With many pension plans, you can benefit from tax relief, which means it can cost you less to have more money saved into your plan.

Let’s say you pay tax at the basic rate of 20%. It’d only cost you £80 to have £100 saved into your plan – the remaining £20 comes from the government.

You can learn more about tax relief in our article. Depending on how your pension scheme works (if you’re in a salary sacrifice or salary exchange scheme, for example), you might get tax benefits in a different way. So do check with your employer. And don’t forget, your own personal circumstances, including where you live in the UK, will have an impact on the tax you pay. Laws and tax rules may change in the future.

Getting a financial boost from the government could make a difference to your pot size over time. And keep in mind that your money is invested and could grow further over the years. Focusing on the various benefits could help you understand how to make the most of your plan. For example, if you can afford to, you might decide to pay a bit more in to take advantage of the benefits.

Potential next steps

Spending some time reviewing your pension plan and doing a bit of admin when you’re 30 or under could benefit you in the long run. Some actions you take now could potentially help you increase the amount of money you have in retirement.

If you’d like to check the current value of your pension plan or update your personal details, you can usually do this online. If you’re a Standard Life customer, you can check how your money’s doing by logging in online. If you're not registered for our online servicing, you can find out more about it on our website.

If you have a personal pension plan with Standard Life and you’d like to change how much you’re paying in, you can also do this through our app or online.

Got a Standard Life workplace pension? The way you can change what you’re paying into your plan is slightly different – but just as quick and easy. Speak to your employer to find out how.

And if you want more information on saving for your future, check out our other MoneyPlus articles.

The information here is based on our understanding in May 2023 and shouldn’t be taken as financial advice.

A pension is an investment and its value can go down as well as up and may be worth less than was paid in.

Standard Life accepts no responsibility for information in external websites. These are provided for general information.