Understanding investment risk

All investments carry some kind of risk – but it’s risk with the aim of growing the value of your money. So it isn’t necessarily a bad thing. It’s just important that you’re aware of, and comfortable with, the types of risks that come with investing.

It’s also important to understand how much risk you’re comfortable taking – otherwise known as your attitude to risk – as well as how much risk you’re able to take with your money – otherwise known as your capacity for loss.

This can help you make an informed decision about where best to invest to meet your goals. It will also help when you review your investments. This is because how much risk you’re comfortable and able to take can change as you move through life and your financial goals change.

What is investment risk?

When you mention investment risk, most people will probably say it’s the risk of not getting back all the money you’ve invested – sometimes called ‘capital risk’. This is an important risk, but it isn’t the only one.

There are other factors which may have an impact on how investments will perform, and fall under the umbrella of ‘investment risk’. For example, ups and downs in financial markets, interest rate and inflation changes, legislation, politics, wars and conflicts, even weather events can all have an effect on investment performance.

Different types of investments also have specific risks which will affect how they’re likely to behave and how much potential they have to grow in value.

Balancing risk and returns

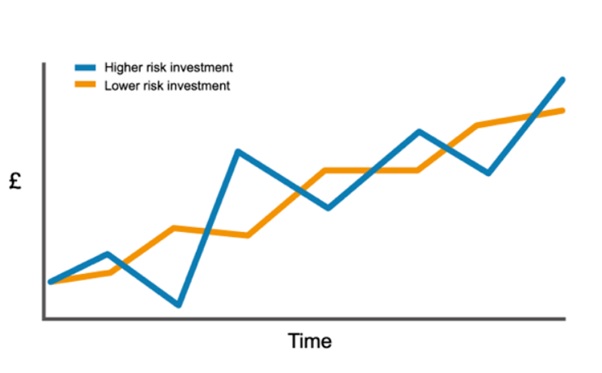

Generally speaking, the more risk you’re willing to take with your investments, the more they’re likely to grow in value over time. But although higher risk investments can make you more money in the long term, they also tend to move up and down more in the short term – see the chart below for an example.

That’s why people tend to consider higher risk investments for longer-term goals, as they’ll have more time to bounce back from any short-term losses (although this isn’t guaranteed).

For each of your financial goals, you need to find the right balance between:

- how much risk you’re comfortable and able to take with the money you invest

- how much you’re looking to get back

- how long you’re investing for

Reduce the risk of not meeting your goals

As we’ve already mentioned, how much risk you take with your investments can really have an impact on how much they could grow over the long term, and whether you’ll meet your financial goals.

Sometimes people don’t take the right level of risk to achieve these goals. Taking too much risk might mean you experience sudden and significant falls at the point when you need to take money – for example, when you’re starting to take money from your pension savings.

On the other hand, very low risk investments may not grow enough to keep up with inflation, so won’t grow in value in real terms.

To help make sure you meet your goals, here are some things you can do:

- Diversify your investments – learn more about diversification on our dedicated page

- Think about having at least some of your money in investments which have the potential for higher returns over time – take a look at our guide on the different types of types of investments to learn more

- Invest for longer – the longer you’re invested for, the more time your investments have to recover from any short-term losses

- As you get closer to your goal’s end point, consider moving into lower risk investments which are less likely to experience large short-term falls

Other risks to be aware of

As well as the general investment risks, different types of investments have their own specific risks.

While it’s a good idea to spread your investments across a range of countries, as well as different types of investments, investing in other countries does have some additional risks. For example, movements in currency exchange rates may have an impact on the returns you get from overseas investments.

Understanding your attitude to risk

We have a questionnaire that can help you understand how much risk you’re comfortable taking with your investments.

Learn more about investing

-

Where to invest

Not sure where to invest your money? Our guide gives you an overview of your options to help you decide what’s best for you.

-

What is diversification?

Diversification, or spreading your money across different types of investments, can help smooth returns. Our guide explains more about the benefits and how you can diversify.

-

Investment options

Discover our range of investment options to suit your needs and goals.