Pensions

Three reasons to show a pension some love

Discover three reasons why it just makes sense to show a pension some love.

id

Feeling in the Valentine’s spirit? Here are three reasons why you should show a pension some love.

1. Because a pension comes with tax benefits

The tax benefits you get from a pension are hard to find anywhere else. Not only do you usually get 25% of a pension pot tax-free, but you also get tax relief on the payments you pay into a pension.

In a nutshell, the government encourages you to pay into a pension by giving you back the money that you would have otherwise paid in tax. How you get this tax relief will depend on the type of plan you have – for example, in some cases, the extra money will go straight into your pension. In others, your pension payment will come off your salary before you pay any tax. But the general idea is the same for everyone.

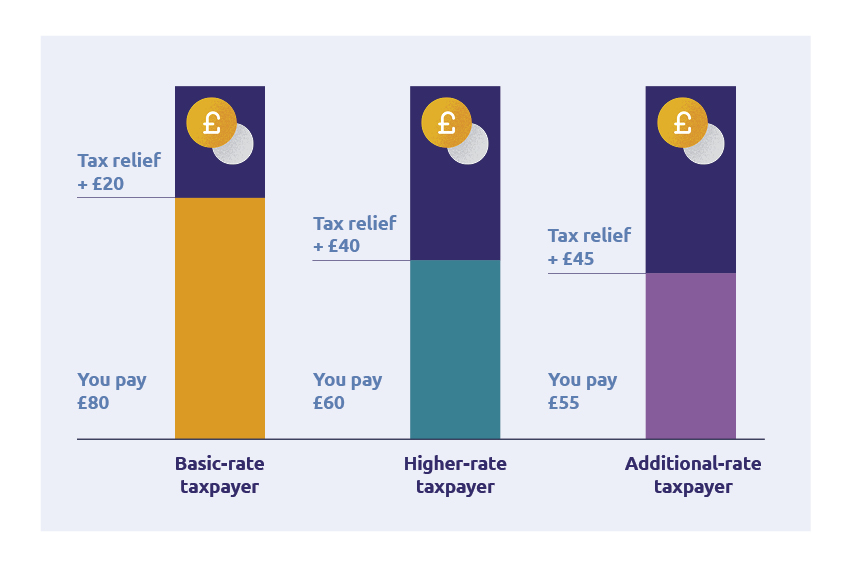

You get tax relief based on the rate of income tax you pay. So, if you pay basic-rate income tax (20%), you’ll get tax relief on your payments for the same amount. Meaning it’ll cost you £80 to pay £100 into a pension.

If you’re a higher-rate or additional-rate taxpayer who pays 40% or 45% in income tax, it’ll cost you less. A £100 payment would cost £60 for a higher-rate taxpayer and £55 for an additional-rate taxpayer.

id

Remember income tax bands are different in Scotland. And keep in mind the extra boost isn’t always automatically applied for higher or additional-rate tax relief, so you might need to claim it back.

2. Because you’re not the only one showing it some interest

If you’ve been automatically enrolled into a workplace pension through your job (which most people will have been), then your employer pays into your plan too.

They need to pay in at least 3% of your qualifying earnings – that’s anything between £6,240 and £50,270. And, in some cases, they’ll pay in more or offer to match your payments up to a certain percentage as an employee benefit.

But if you opt out of your workplace pension scheme, or don’t take your employer up on their benefits, you could be missing out on a big chunk of income when it’s time to retire. So take the time to brush up on what your employer offers.

3. Because if you don’t love it, you could lose it

Had a few jobs? Then you’ve probably got a few pensions too. It’s easier than you think to lose track of old pension plans. Every time you get a new job, a new one is opened for you. And if you don’t keep tabs on the old one, it can be forgotten about.

If this has happened to you, you’re not alone. There’s more than £26 billion sitting in lost pensions just now, with the average pot worth more than £9,000.

The good news is you can track down what’s yours. All you need is your National Insurance number and some information about your past employers or pension providers. You can feed that information into the government’s Pension Tracing Service and it can help you find your old plans.

Ready to show your pension some love?

You can check in on your Standard Life pension online. Find out more about our online services on our website, or for help, FAQs and ways to get in touch, visit our support page.

The information here is based on our understanding in February 2024 and shouldn’t be taken as financial advice.

Your own personal circumstances, including where you live in the UK, will have an impact on the tax you pay. Laws and tax rules may change in the future.

Standard Life accepts no responsibility for information in external websites. These are provided for general information.