Pensions

Got your own business? Try our pension tax tips

If you’ve got your own business, your pension plan can offer some serious tax breaks. Read our article to find out how to make the most of them.

id

Being your own boss comes with a lot of benefits and freedom. And being able to wear the hat of both boss and employee comes with some serious tax advantages when it comes to your pension plan.

1. Make the most of pension tax relief

When you make a personal payment into your pension plan, you get a boost from the government in the form of pension tax relief.

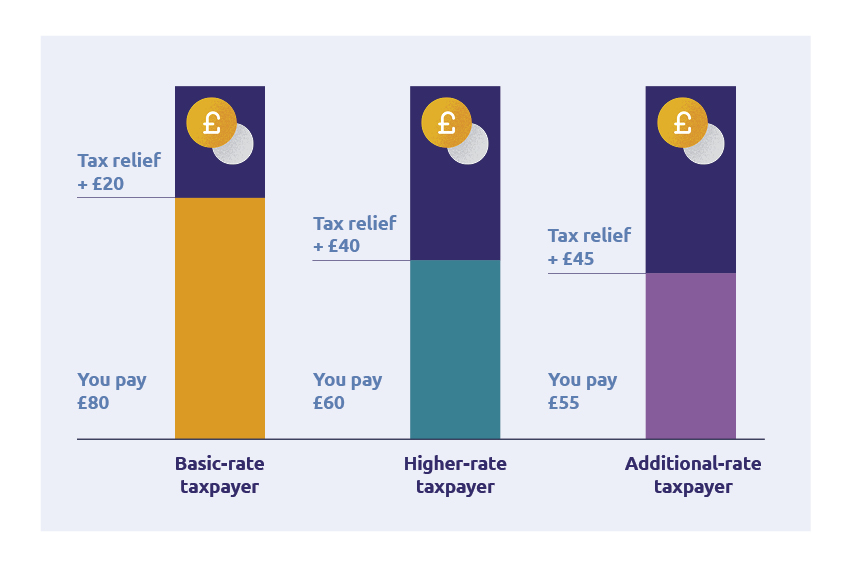

A basic-rate taxpayer pays 20% in income tax, so in turn they get 20% back in tax relief on their pension payments. So, for example, let’s say you pay £80 into your pension plan. You’ll get a £20 top-up on that payment, so the actual amount that goes into your plan will be £100.

If you’re an additional or higher-rate taxpayer, who pays 40% or 45% in income tax, you’ll be entitled to even higher rates of tax relief. Meaning a payment of £100 into your pension plan would only cost you £60, or even £55.

id

Here’s the bit to keep in mind, though. Your pension provider will claim the 20% for you, but you need to claim anything above that back from the government in your tax return.

You might get tax relief on your payments in a slightly different way (by an adjustment to your tax code, for example) but the overall tax benefit to you is the same.

2. Pay in through business contributions

Most people will get pension tax relief on their personal pension payments, but if you own your own business, the tax benefits of a pension plan don’t stop there. Limited company directors can pay in through their business account. If you do this, your payment will act in the same way as an employer payment would to anyone else, so it’ll be treated slightly differently.

First, it’ll mean you pay into your pension plan before any tax is deducted from your income – so you’ll pay less income tax and national insurance.

Even better news: business contributions to your pension plan will be treated a business expense, so you’ll pay less in corporation tax, too. Essentially what this is doing is reducing your company’s profits on paper, but lets you keep more of your money in the long term.

Let’s look at an example

Ben makes £100,000 in business profits in a year. He’ll pay 19% in corporation tax and another 7.5% in dividend tax. In total, that’s £26,500 in tax.

But if he made a £10,000 payment to his pension plan from his business account, he’d save on the corporation tax and dividend tax he would have paid on that amount. Meaning only the remaining £90,000 would be subject to those taxes.

So, in this case, he’d save £2,650 in tax, which he’ll eventually get in his pocket instead.

3. Make the most of your annual allowance

Whether you’re paying into your pension plan as an individual, a company director, or both, you’ll still be impacted to some extent by the pension annual allowance. This is the total amount you can pay into your pension plans without facing a tax charge.

Currently, it’s £60,000 or your total salary – whichever is lower. But here’s the twist: where most people are impacted by the salary, limited company directors aren’t. So if the amount you pay yourself as a salary is, say, £30,000 a year, the total you could usually pay in would be £30,000. However, as a director, you could still pay in the full £60,000 if you pay it through your business account.

How to get started

Need to set up a pension plan or transfer your old plans to a new one? Our personal pension can help you make the most of all these tax benefits and is perfect for limited company directors. It’s quick and simple to set up and you can easily manage your plan online or through our highly rated app – so you can spend less time on admin and more time growing your business.

id

The information here is based on our understanding in June 2023 and shouldn’t be taken as financial advice.

A pension is an investment and its value can go down as well as up and may be worth less than was paid in.

Your own personal circumstances, including where you live in the UK, will have an impact on the tax you pay. Laws and tax rules may change in the future.