Pensions

6 numbers that explain what’s so good about a pension

Not sure how exactly your pension plan works or how to maximise its benefits? Give us five minutes to bring you up to speed with six numbers that really count.

id

If you’ve set up a pension plan or had one set up at work but haven’t really paid it much attention yet, you might not know how exactly it works, what it can offer or how to maximise its benefits. But give us a few minutes and we’ll bring you up to speed with six numbers that really count.

1. 10 years of auto-enrolment

The number of people taking up pension plans to save for their future is on the rise. When employees started being automatically enrolled into pension schemes in 2012, only 4 in 10 people had a workplace pension. That figure is now almost 9 in 10.

What’s so good about a workplace pension scheme is that your employer is contributing to your future too (a minimum of 3% of your qualifying earnings). Some employers choose to pay more than the minimum and others will pay more into your pot if you do – known as matching.

If you’re eligible and it’s suitable for you, but you haven’t joined your workplace pension scheme, or you’re not taking full advantage of what you’re entitled to, you could be passing up on what is effectively ‘free money’.

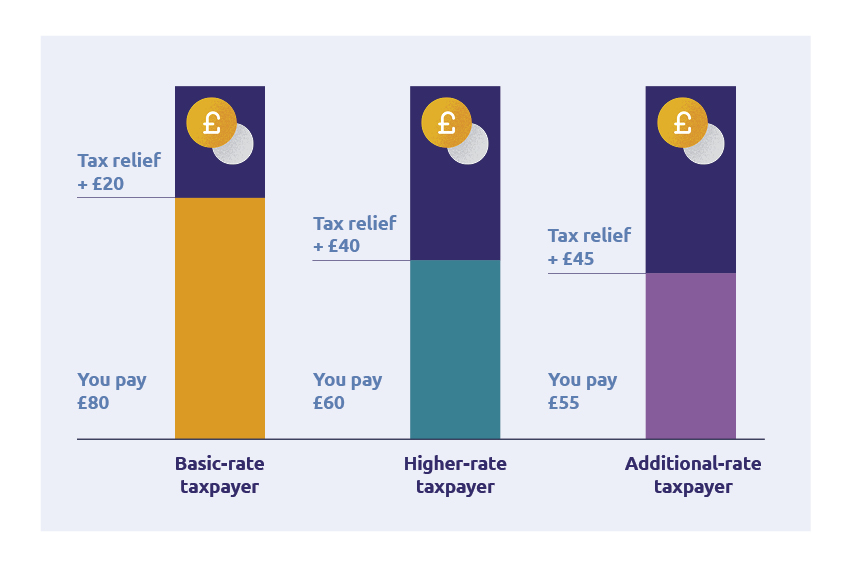

2. 20% minimum in pension tax relief

One of the biggest benefits of your pension plan is how tax-efficient it is. Most people will get pension tax relief on their pension payments. What this effectively means is the government will boost your pension payments, so paying into your pension plan may cost you less than you think.

The amount of tax relief you get depends on the amount of income tax you pay. If you’re a basic-rate taxpayer, you’ll get 20% tax relief on your payments. A higher-rate taxpayer will get 40% and an additional-rate taxpayer will get 45%.

What this means in real terms is paying £100 into your pension plan could only cost you as little as £55 depending on how much income tax you pay. And you don’t get those kinds of tax benefits with any other savings product.

You can find out more about how pension tax relief works in our article.

3. 25% of your pot tax-free

Speaking of tax benefits – here’s another big one. When you come to take your pension savings, you can take a quarter of your pot without paying tax on a single penny of it.

And if you’ve started saving early and grown your pot over a number of years, that could be a lot of tax-free money by the time you come to take your savings.

You can find out more about tax-free cash and how it works in our article.

4. 67% of people don't realise their pension savings are invested

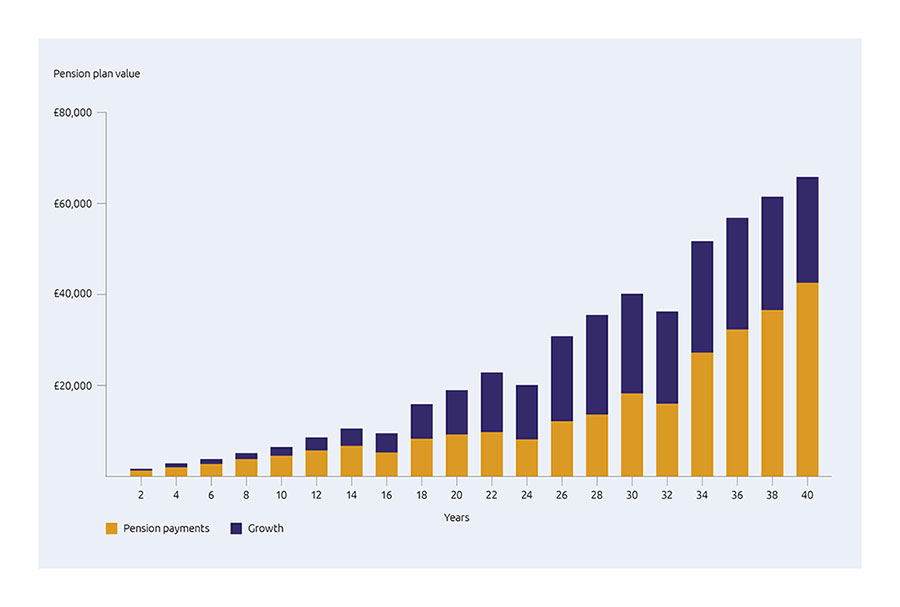

One of the great things about a pension plan is that any money paid in by you or your employer is invested on your behalf.

What this means is that it will have the chance to grow over time and hopefully give you back more than you invested by the time you come to take it. Plus, the earlier you start investing your money, the more likely you are to benefit from compounding – which is the effect of growth on growth. So even starting out with small payments to begin with could make a big difference in the long run.

The potential impact of compounding:

id

This graph is for illustrative purposes only and isn’t based on real figures. Remember the value of investments can go down as well as up and you may get back less than was paid in.

However, only 33% of people are aware of this benefit, which could impact their investment choices and therefore how much they could end up with in retirement.

Where you choose to invest could make a big difference to your future. Some people like to review and choose their investments while others are happy to leave these decisions to investment managers. You should think carefully about how involved you would like to be.

You should bear in mind that as a pension plan is an investment its value can go down as well as up and you could get back less than what was paid in.

5. £10,600 - how much a full State Pension would give you each year

Currently if you’re eligible for the full new State Pension you would receive just over £10,600 a year. That’s less than a minimum wage salary and is unlikely to be enough to give you what you want or need to live off when you come to retire. On its own, the full amount would cover less than a 'basic' lifestyle (according to the Retirement Living Standards) and, because it only starts in your late 60s, it won’t help support you if you want to retire earlier.

This is where your pension plan comes in. Not only can you take your pension savings earlier than you can get your State Pension, but your pension savings will help you top up that income and help you live the kind of life you want to have after work.

That’s why it’s so important to pay attention to your pension plan and make sure you’re saving enough now, so your future you will thank you.

Ready to set some goals? Read our article to find out how much you might need to retire.

6. £26.6bn 'lost' in forgotten UK pensions

One last figure to consider is the number of pension plans that are ‘lost’ or have been lying dormant – an estimated 2.8 million pots worth as much as £26.6bn. If you’ve changed jobs or even moved home, some of that could be yours.

The good news is there’s a government website to help you track them down. Once you’ve found them, you could consider combining them into one to make things a bit easier.

Bringing your pensions to Standard Life

If you think combining your pension plans is right for you, why not bring them together into one with us? It takes as little as five minutes to apply online and could help you feel more in control of your future. Here’s how:

- We won’t charge you to bring your pensions together

- Easily access your money from age 55 (age 57 from 2028)

- Start, stop or change your payments at any time

- Manage your money online or on our app

id

The information here is based on our understanding in August 2023 and shouldn’t be taken as financial advice.

A pension is a long-term investment. Its value can go down as well as up and could be worth less than was paid in.

Laws and tax rules may change in the future. Your own circumstances and where you live in the UK will also have an impact on tax treatment.

Related Articles

-

How to find old or lost pension plans

Lost a pension plan from an old job? Read our guide to find out how you can trace and find your old plans. MoneyPlus Features Team

MoneyPlus Features TeamApril 14, 2025

Read more3 mins read -

Spring Statement 2025 – at a glance

A few things to know about Rachel Reeves’ 2025 Spring Statement. MoneyPlus Features Team

MoneyPlus Features TeamMarch 26, 2025

Read more2 mins read -

How can you take money from a pension plan?

There are a few different ways you can take money from a pension plan. Learn more about your retirement options. Morgan Laing

Morgan LaingMarch 18, 2025

Read more4 mins read