We’ve created an employer guide to pension transfers which explains how you can point employees towards useful resources and information.

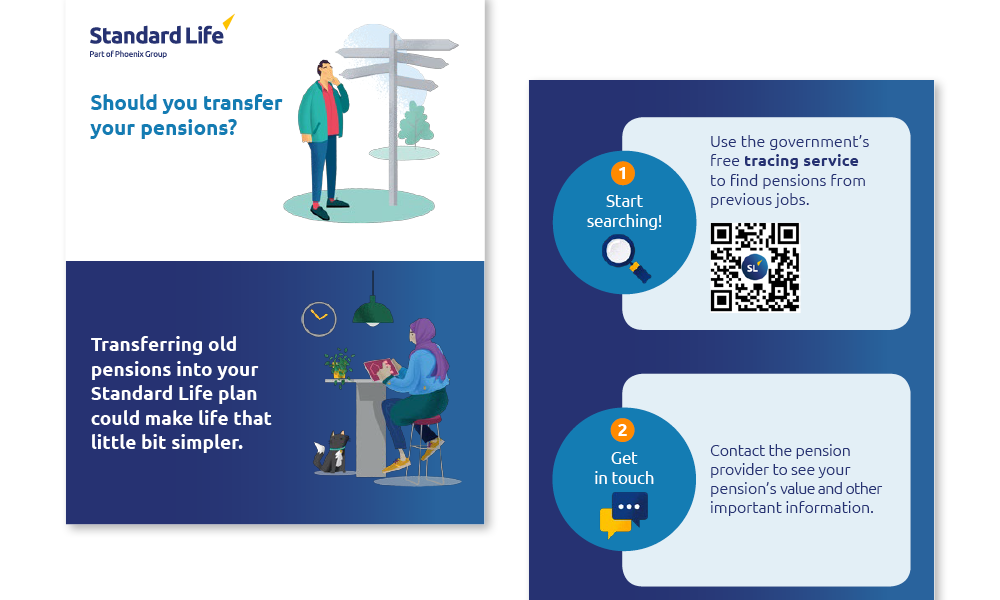

You can also download our employee pension transfer materials, which gives them an overview of the steps involved.

If employees decide that combining is right for them, it’s quick and easy for employees to bring their pensions together. Employees can start the pension transfer process using the Standard Life app, giving them the ability to manage everything in one place.

When people have lots of pension pots dotted around, it can be difficult for them to see how much they’ve got, making retirement planning feel complex and overwhelming. This could have a negative impact on their financial wellbeing – and affect workplace productivity and performance as a result.

We can help your employees bring their old pension pots together, so they can see how much they’ve got in one place. This can help them feel more confident about retirement planning – and help boost their financial wellbeing in the process.

Having a better understanding of finances in general can help employees feel financially well. Our digital platform, Money Mindset, gives them instant access to bitesize content and tools, which could boost their financial knowledge and help them manage their money with confidence.

What’s holding some people back from combining their pensions? According to our Retirement Voice 2023 report, not knowing how to consolidate (25%), uncertainty around whether their savings are better staying as they are (17%) and worrying about making a mistake (13%) are the main blockers to taking action.

If your employees have pension savings spread out over multiple pots, it makes it difficult for them to see what their future could look like. Combining pensions could help employees connect more with their pension savings and help them to stay involved with their financial planning. When everything is in one place, it can feel much easier to track and manage.