Using Client Analytics - case studies

If you've registered for Client Analytics or are thinking about doing so, here are two different case studies you can have a walk through. These will help bring Client Analytics to life, and we'll also offer some suggestions about how to deploy your new data insights to help strengthen member engagement.

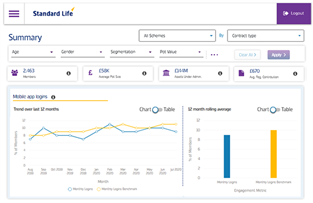

Case study 1 - engagement levels of younger members

For our first case study, we set the Client Analytics age filter to select members aged 24 and under. What stood out straight away when we looked at member logins was a lack of engagement within this demographic.

What can we do to improve this?

In a case like this, we need to build engagement, and make the members feel in more control of shaping the future they want, however far away it might feel.

If you run this analysis and get something similar, you may want to do some general promotion on building awareness and understanding. This younger population are perhaps more likely to expect everything to be online, so encouraging them to view our Pensions Explained video on their mobile could be a good start. You could combine this with helping them to engage digitally with their pension plan by promoting the Standard Life app.

Based on the Client Analytics data insights the outline of an approach might be:

| Actionable insights plan 1 | |

|---|---|

| Demographic | < 24 years old pensions scheme members |

| Insight | Lack of engagement |

| Actions | Promote Standard Life mobile app Promote Pensions explained video |

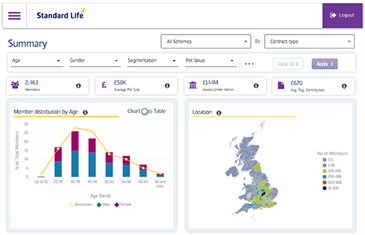

Case Study 2 - engagement levels of members approaching retirement

For our second case study, we looked at a section of the membership bracket which is approaching retirement. This was a large population on our example, and we would expect them to be starting to think about their options when they retire. But engagement levels were low.

So here we have time-poor, slightly older people, who are more likely to know what a pension plan is and that it's important to them. Maybe they just need a friendly nudge to get them thinking about engaging more with their retirement choices? We need to think about how to cut through the daily clutter in a way that suits them, and provide signposting to the information they need, when they need it.

The app might not be the first port-of-call for these members if they aren't typically on their mobile phones a lot, but if they are working remotely or on office PCs, then one approach could be to deploy a short series of promotional emails. For those in the workplace, we have posters and flyers to catch the eye and highlight what options are available. And as with the younger demographic in the first case study, it could be that a video is a quick and easy watch. We have options that bring the story to life.

Based on data insights, and knowing something about the demographic we've analysed in the Client Analytics tool, the outline of an approach might be:

| Actionable insights plan 2 | |

|---|---|

| Demographic | < 5 years to retirement pension scheme members |

| Insight | Lack of time to spend on retirement planning Lack of engagement generally Less likely to be mobile-driven |

| Actions | Send promotional e-cards for a quick-read nudge Deploy workplace posters – canteen, entrance Promote Pensions explained video |

Putting your Client Analytics data into practice

If you haven't done so already, why not register for Client Analytics now, and start planning your member engagement campaigns.

You can access our full Ready-to-go campaign catalogue online and place your order for free, at any time.

Whats next?

-

Client Analytics FAQs

Hints, tips and how-tos to help you get the best out of Client Analytics

-

Ready-to-go campaigns

Free resources to help drive effective colleague engagement

-

Access Client Analytics

Get registered and start reviewing your member behaviour