Access your plans anytime, anywhere

Investment returns aren't guaranteed. The value of your investment can go down as well as up and may be worth less than what was paid in.

Manage all your plans in real time

Withdraw from and top up your plan online

Keep your details and beneficiaries up to date

View your plan value and manage your investments

Get in touch with our team through secure messaging

- If you need any help with your plan, send a message to someone in our team

- Add any documentation as an attachment

- Usually receive a reply in one business day

-

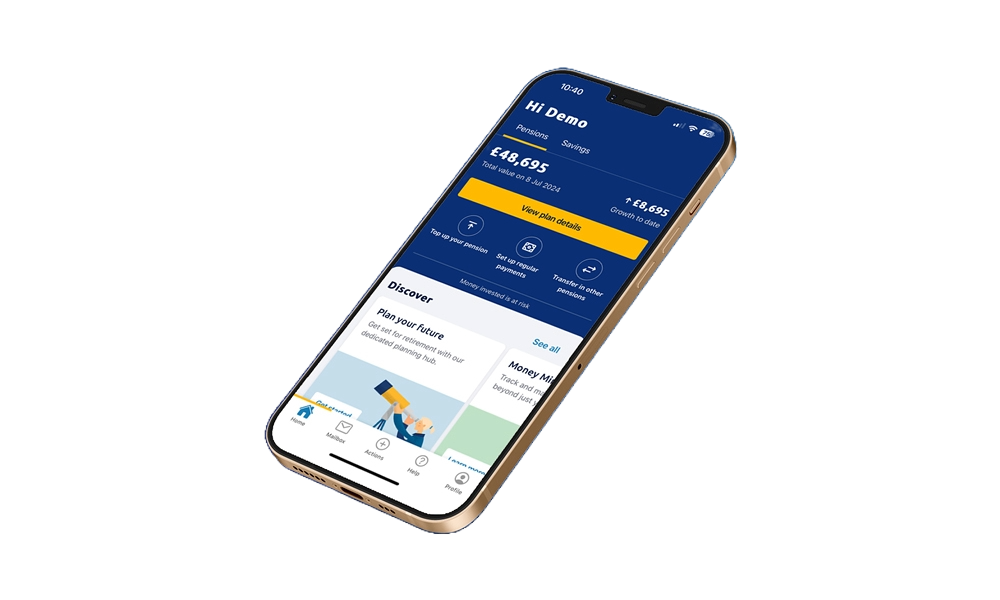

The Standard Life App

See what features are available to you when you download the Standard Life mobile app.

The Standard Life App

0 seconds of 2 minutes, 7 secondsVolume 90%Press shift question mark to access a list of keyboard shortcutsKeyboard ShortcutsShortcuts Open/Close/ or ?Play/PauseSPACEIncrease Volume↑Decrease Volume↓Seek Forward→Seek Backward←Captions On/OffcFullscreen/Exit FullscreenfMute/UnmutemDecrease Caption Size-Increase Caption Size+ or =Seek %0-9Live00:0002:0702:07Our mobile app makes it easier for you to engage with your pension wherever you are.

It empowers you to take control of your future, providing quick access through fingerprint and facial recognition.

With just a few clicks, you'll be able to:

- View the value of your plan

- Track investment performance

- See your payment history, and

- View your charges

Handy functions also make managing your pension plan straightforward. Depending on the type of plan you have, these include being able to:

- Change your investment choices

- Update your personal details, including your beneficiaries and selected retirement date

- Make top up payments

- Transfer in other pensions

- Trace any lost pensions

- Access your pension savings

There are also interactive tools to help you plan for retirement. These can give you an idea of the type of lifestyle your projected retirement income could provide, and help you to understand the potential impact of actions you can take now.

And if you need a helping hand with anything, you can get in touch with us through secure messaging, where you can easily and safely send us important documents.

You can also choose to go paperless and access your documents through a secure digital mailbox, empowering you to manage things in a more environmentally-friendly way.

Our app is a great way to get closer to your pension. But don't just take our word for it - others like you are benefiting today.

Please remember, a pension is an investment, the value can go down as well as up, and you may get back less than was paid in. Transferring other pensions won't be right for everyone. You need to consider all the facts and decide if it's right for you.

-

Access your personalised dashboard

Watch our short video to see how you can easily manage your plan online.

Access your personalised dashboard

0 seconds of 2 minutes, 58 secondsVolume 90%Press shift question mark to access a list of keyboard shortcutsKeyboard ShortcutsShortcuts Open/Close/ or ?Play/PauseSPACEIncrease Volume↑Decrease Volume↓Seek Forward→Seek Backward←Captions On/OffcFullscreen/Exit FullscreenfMute/UnmutemDecrease Caption Size-Increase Caption Size+ or =Seek %0-9Live00:0002:5802:58These days, we can manage almost every aspect of our lives online - why should your pension be any different? With online servicing, you can quickly and securely engage with your pension in a way that suits you.

Registering takes minutes, and once logged in, you'll enter your own personalised homepage where you can see how much is in your pension pot, and other important information. There's even a personalised video, updated in real-time, which shows how much this could be worth in the future, as well as tips on how you could potentially boost this.

You can customise your experience by pinning or dismissing content, letting you see messages which are most relevant to you.

Diving deeper into the 'Your Pension' page, you can view the charges you're paying and take action through a number of handy functions. Depending on the type of plan you have, these include:

- Combining pension plans to give a single view of what you have.

- Reviewing your investment choices, and switch them easily. There's even a tool to track funds you're thinking of investing in.

- See your regular payments, and make top up payments in just a few clicks.

Next, pop over to the 'Your details' section, where you can:

- Make sure your personal details are correct.

- Update your beneficiaries so we know the loved ones, charities or causes who your savings should go to after you're gone.

- Review your selected retirement date - it's easy to do and means you can plan better and receive communications at a time that's more relevant.

There's also a wide range of educational material to help you learn more about different pension topics:

- To increase your understanding of investments, head over to the investment hub, where you'll find a wide range of useful guides on how investing works and what it means for you.

- Our dedicated Plan your Future hub also offers a host of helpful information and interactive planning tools. These give an idea of the type of lifestyle your projected retirement income could provide, and allow you to understand the impact of actions you can take now.

And finally, if you're unsure about anything, drop us a question through secure messaging - we're on hand to help.

Thousands like you are already benefiting from online servicing - join them to take control of your future today.

Please remember, a pension is an investment. The value can go down as well as up, and you may get back less than was paid in. Transferring other pensions won't be right for everyone. You need to consider all the facts and decide if it's right for you.

-

Need a hand?

Watch our app and online dashboard how to videos.

See your retirement income and lifestyle

- Get a picture of your retirement income

- See what your retirement lifestyle could be

- Explore options like changing your retirement age